Save money, time, and trees!

More and more organizations are taking their payroll paperless, and HR One is helping our clients make the move towards a more efficient and affordable way to pay their employees.

|

How to get started:

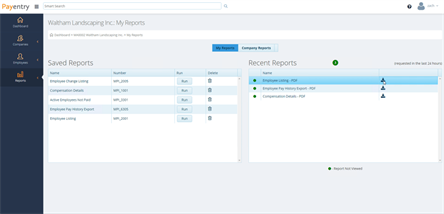

HR One offers our clients Secure View; reporting tools that give you on-demand access to

Employer copies of quarterly returns

Employer copies of the W-2, 1099, and ACA 1095 reports

Employee copies of W-2's

You can download these files to save, review, and distribute as needed. You'll receive an email notification when the files are available. You can also go back and find previous versions of these forms!

Next, give your employees the tools they want to manage their pay without all the paper!

|

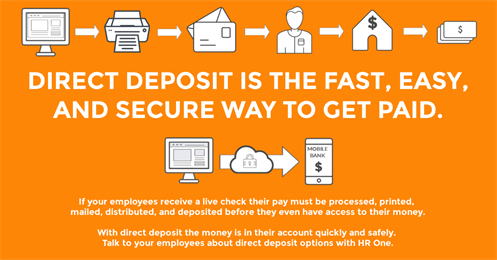

Talk to your employees about the benefits of direct deposit. If your employees are on direct deposit you don't need to rely on the post office or delivery services losing your payroll or having it delayed. They won't need to make in-person visits to the bank. They can't lose live checks if the funds are going directly to them, and no more delays on an employee cashing a check. It's more efficient and more secure.

Need help convincing employees who are reluctant to give up live checks? Some employees are worried that direct deposit may cost them money, when actually, it can be less expensive than live checks. Many financial institutions will waive account maintenance fees if you have direct deposit; whereas there are many institutions that actually charge a fee to cash a check. Some financial institutions like credit unions may have fewer restrictions on opening an account than traditional banks.

|

My Payentry lets employees quickly access paystubs, check paid time off balances, log time punches, and more; all from a smartphone or desktop.

And what's more, it's a secure platform that uses two-factor authentication to protect your employee's personal and financial information.

Employees can keep their personal profiles up to date using My Payentry

At anytime users have access to review the information that is most important to them

Next, think of the material savings of going paperless. If you have 52 pay periods in a year, and each pay period you need to print at least one full page of paper for each employee with their check and the paystub, not to mention the envelopes to keep them separated and private, think of how much paper you're saving. Then add in the costs to ship the payroll. You'll also save physical space- no more bulky file cabinets taking up space where you work.

Finally, in the age of COVID-19 HR One’s web-based payroll application helps to ensure your payroll can be processed from anywhere as long as there is an internet connection, which includes from home in the event this becomes necessary. If you can avoid the physical reciept and distribution of reports and checks then you can operate not only more safely, but more confidently in these uncertain times. Early in the outbreak many clients took advantage of this paperless option.