Payentry helps you make sure ACA reporting is accurate

|

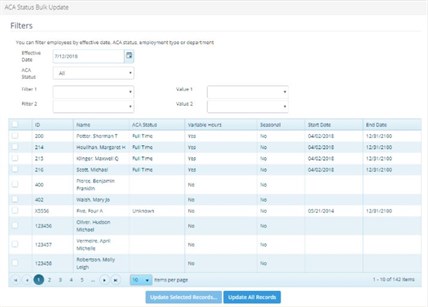

HR One can help your organization to determine the portions of the Affordable Care Act which your organization is subject to and what, if any, reporting requirements you may be subject to. For HR One payroll clients, our system has the tools that can actually assist you in completing the reporting and filing requirements.

If you have a self-insured health plan or have a fully insured plan and at least 50 full-time employees or 50 full-time equivalent employees you need to file information returns to the IRS regarding health insurance coverage offerings (a full-time employee generally includes any employee who was employed on average at least 30 hours of service per week).

|

For HR One's payroll clients, the Payentry system has the tools to assist you in collecting and organizing the information you'll need for the reporting and will be able to file the reports for you in a timely manner.

|